Trading bots are the object of many fantasies, but what is a trading bot really? For the first article in our guide about trading bots, we believe it is essential to define them, to put an end to all speculation (no pun intended).

What is a trading bot?

A trading bot is software that trades, i.e. buys and sells assets with the aim of making a profit. There are trading bots for all types of assets: for cryptocurrencies such as bitcoin or ether, but also for shares, currencies, etc. Just as a trader will monitor the markets to find the best opportunities, a trading bot will monitor the markets and react to conditions with actions.

For example, a trading bot will monitor the bitcoin/dollar market (BTC/USD), and as soon as the price of Bitcoin exceeds $12,000 (this is the condition), it will sell 1 BTC (this is the action).

All these conditions and actions are pre-programmed by traders (maybe you soon 😉). Of course, conditions and actions can be much more complex, using technical analysis tools, artificial intelligence, etc.

What is the purpose of a trading bot?

Trading bots are generally used to generate profits, but they can also be used to invest more efficiently (e.g. with the Dollar Cost Averaging strategies wel will discuss later), or even to protect your capital.

Of course, a distinction must be made between trading bots for individuals and for companies. The needs are not at all the same, and neither are the budgets… We will speak very little about high frequency trading and arbitrage for individuals since these activities require specific infrastructures.

How does it work?

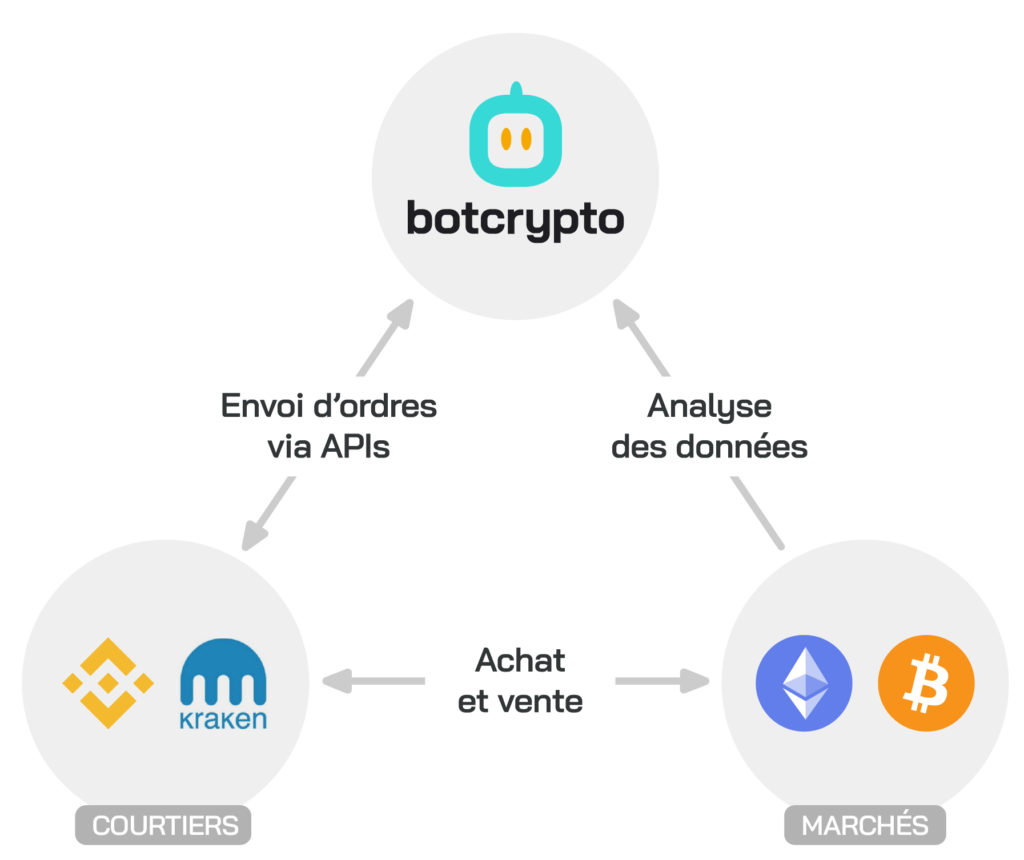

For anyone interested in knowing how it works, here are some explanations. Without going into technical details, we are talking about a software that:

- retrieves market data

- checks conditions (if the price of bitcoin exceeds X €, if the exchange volume increases by Y%, …)

- execute actions (sell Z BTC, …)

And that’s it! Thanks to a dedicated interface, called an API, a trading bot can send orders on your behalf directly to your preferred exchange. For this reason, you generally need to provide API keys to all services that use an API. This is simply to identify and authenticate you.

Finally, a trading bot must be operational 24/7, otherwise it loses much of its interest. This is why they are usually deployed on servers in the cloud. We strongly advise against hosting your trading bot yourself without having the skills and the time. If you want to know more about this, join our Discord server to discuss with our team. We will be happy to discuss this with you.

Now you know what a trading bot is, and even how it works! Now you want to know what the real advantages of trading bots are? That’s good, that’s the subject of the next article!