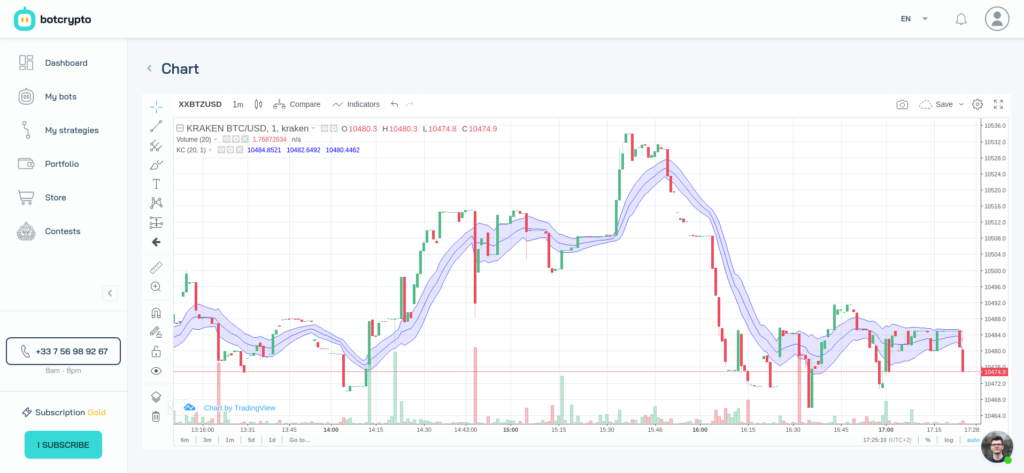

Volume is defined as the sum of the volumes traded over a given period. It is often indicated at the bottom of the graph.

It is useful for detecting declines in dynamics, which precede an explosive movement. Also, it is useful for establishing statistics as to the price.

A price traded at high volume indicates a great interest on the part of the actors, which reinforces the supports or resistances.

Also, the volume allows to show the activity of the Asian, European and American markets, in order to establish which session is the most influential, therefore the session which has the most volatility.

How to use volume ?

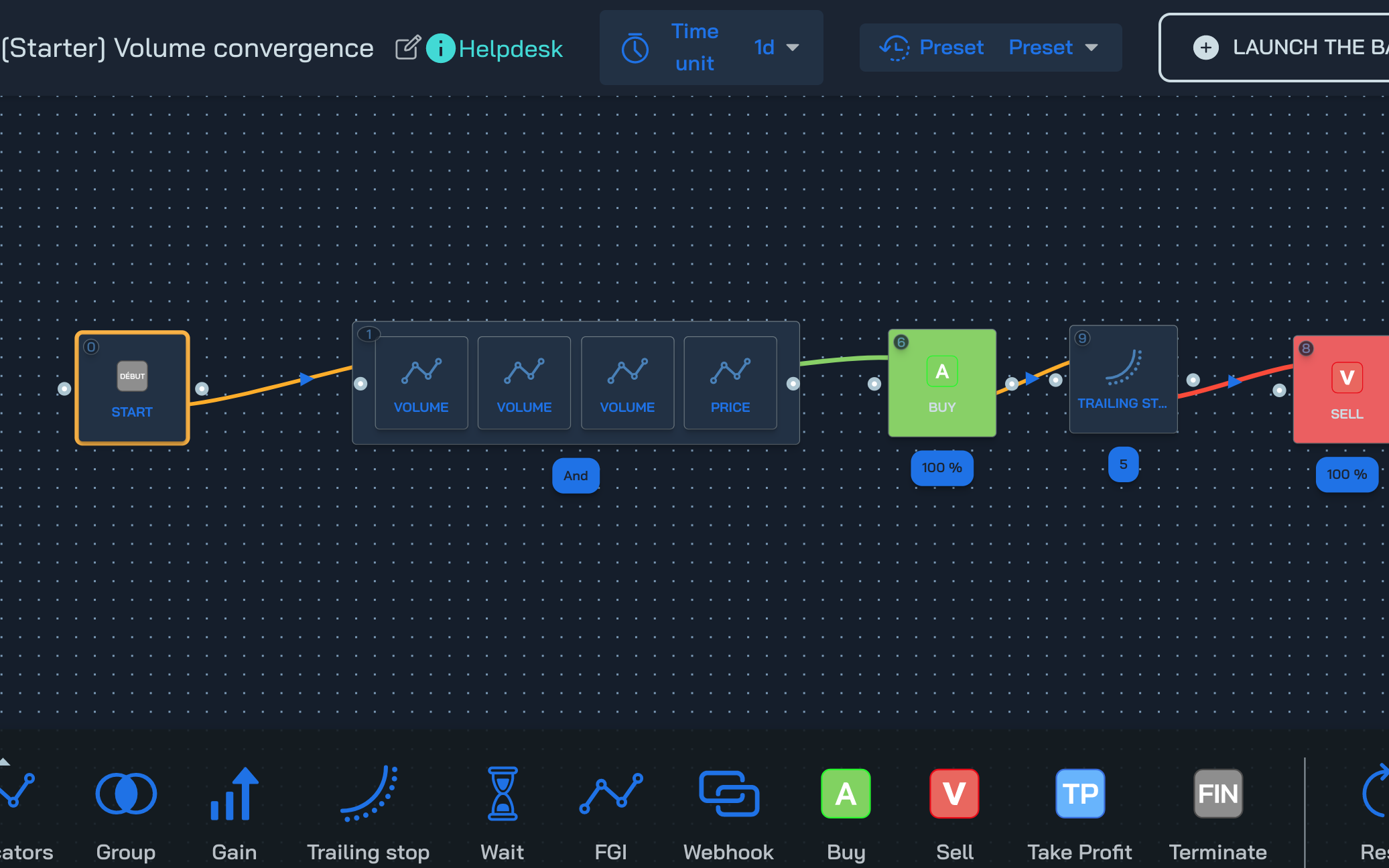

The main interest of volume is to detect periods of weak & strong activity, by relating the price. Although mainly used as a guide, you can establish a strategy based on the convergences of price versus volume in order to detect changes in direction.

- If the volume of the last N candles decreases and the price also decreases, it is likely that a whale will cause a surprise pump. We must therefore position ourselves to purchase.

- If the volume of the last N candles decreases and the price also increases, it is likely that the last buyers will place themselves. We must therefore position ourselves in the sale.

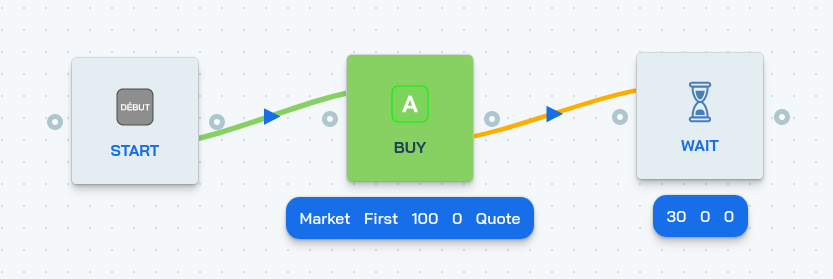

Trading bot with volume, price & convergence

The best part is that this demo strategy is available on the store on botcrypto. This means that you can now create a trading robot with this strategy!