Welcome to the second article of our guide about trading bots! Trading bots are becoming more and more common, especially in cryptocurrencies markets. They are attributed many qualities. Some people think they are THE solution to get rich easily and quickly (spoiler, it’s not so easy and fast). Others think, on the contrary, that it is a scam and that there is no point. After 3 years of working on Botcrypto, we are convinced that trading bots have real advantages, but also limits. That’s why we will see in this article what you can expect from trading bots, and what you can’t.

The 4 real advantages of trading bots…

1. Trading bots are operational 24/7.

Unlike us, trading bots are operational 24/7. This is particularly interesting for cryptocurrencies like bitcoin, where markets are continuously open. This means you no longer need to monitor the prices of your cryptocurrencies in the evening, at night, at the weekend, at work, etc. You save time.

2. Trading bots offer new opportunities

Between their permanent presence on the markets and their ability to process a lot of data simultaneously, trading bots offer new opportunities that humans would not be able to seize. Taking advantage of the best prices at any given time, analysing large amounts of data instantaneously to determine entry and exit points, everything is possible for trading bots that bring the benefits of IT. You gain in efficiency.

3. Trading bots don’t give in to their emotions

Emotions are the trader’s worst enemies. And a trading bot, since it is a bot, does not give in to his emotions. He doesn’t panic (neither up nor down) and applies rationally what he was designed for. This avoids the risks of FOMO, Fear of Missing Out, i.e. the fear of missing an opportunity. You gain peace of mind.

4. Trading bots react quickly

For the same reasons, trading bots react quickly. Very quickly. Not to mention high-frequency trading, which is another subject, trading bots can analyse a lot of data and act accordingly much faster than a human. They will have no hesitation. In highly volatile markets, such as with cryptocurrencies, the ability to react quickly is a considerable advantage. You also gain in efficiency.

… and their limits !

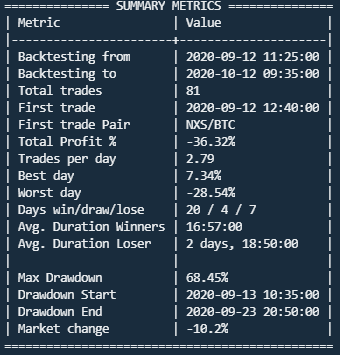

First of all, remember that trading bots only do what they are told. There is no magic. You have to pay particular attention to the configuration, and provide safeguards. Risk management is essential. And as usual, you should not put all your eggs in one basket.

First of all, remember that trading bots only do what they are told. There is no magic.

We can also talk about other limits:

- Cost. Trading bots always involve costs. Regardless of the model (subscription, commission, profit, …), these costs must be taken into account in the results. The rates vary from a few euros to several hundred or even several thousand euros per month.

- Security. In order for a trading bot to use your funds, you must give it access to your account on a trading exchange by sharing your API keys. Of course, sharing your API keys is not trivial. There are good practices to follow as we have explained in this article on API keys. You must carefully select your service providers to keep your funds safe, and in particular respect our 3 rules to avoid being fooled by trading bots (article currently only in French).

You now know the difference the true and false advantages of trading bots. In the next articles, we will learn how to use them correctly to get the most out of them. Do you see other advantages and limits to trading bots? Tell us about them in comments! ✍️

FYI, you mistyped “true” in the last paragraph. “You now know the difference the ture and false advantages of trading bots.”

Fixed thank you!