Why is virtual crypto trading ideal to get started in crypto trading?

When you start in crypto trading, you have to learn a lot of things, and very quickly. First you need to master the basics of trading (see our articles about trading), then fundamental analysis and technical analysis, and finally you need to build a strategy and apply it while managing your emotions and risk.

Anyone who discovers a new field makes mistakes, and trading is no exception. The only problem is that in trading, mistakes are expensive, literally. An interesting solution is therefore to practice with a virtual portfolio, or dummy portfolio, with simulations. Here is a short overview of what crypto’s virtual trading is, and its advantages.

What is a virtual portfolio?

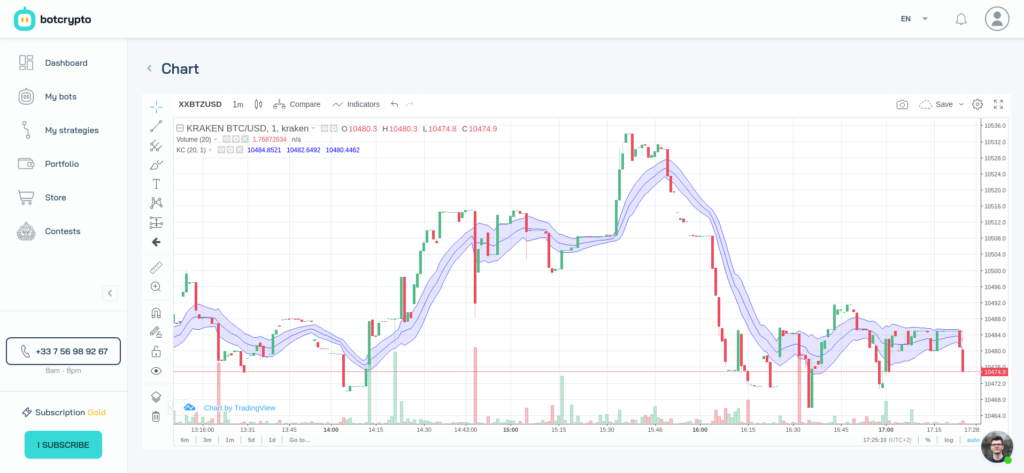

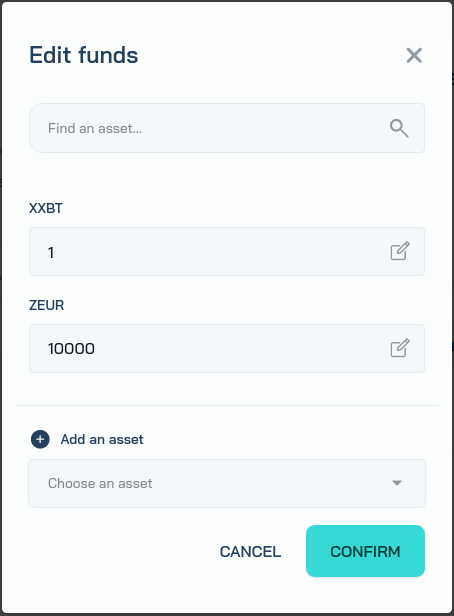

Many trading platforms offer virtual portfolios. On Botcrypto for example, you can create a virtual portfolio with a virtual $10,000, and pretend it is your first investment in cryptocurrencies. You will be able to buy Bitcoin (BTC), but also Ethereum (ETH) and other Altcoins like Ripple (XRP), or Dogecoin (DOGE). You will be able to see the evolution of your funds and investments in complete security, and discover trading by practice!

Managing your emotions

You probably already know that cryptocurrency is a highly volatile asset. At the time of this writing, Ripple (XRP) for example has taken more than 100% in 2 days.

Knowing how to manage your emotions is essential in trading, and even more so in cryptos. You must avoid panic and euphoria at all costs, but also FOMO (Fear Of Missing Out), the fear of “missing the train”. Trading with a virtual wallet allows you to feel these emotions, to understand what it feels like to have “missed the train”. If you see from one day to the next that your portfolio, even virtual, only takes 10% while another asset has taken more than 100%, you quickly feel this sensation, this “if I had done that, I would already be rich“. And you can tame it to control it.

Hold on the long term

It is often said that 90% of stock market traders don’t last more than 6 months, and the number is surely the same in the cryptos. That’s why learning about trading only a few days before investing and trading all your savings is a bad idea. It is also necessary to pay attention to successes. Just because you win in the first week doesn’t mean you’re a good trader. The important thing is to keep the distance. To be profitable 1 year, 2 years, even 5 years later. Training with virtual portfolios is the possibility to see your virtual capital evolve over several months or even years, and prove that you can hold on the long term.

Testing new strategies

Finally, virtual trading is the possibility to test new strategies in complete security. You are an experienced trader, with a strategy that works, but you want to experiment with new indicators, or even a new strategy? Backtests and simulations will be your best friends to save time, and quickly and safely evaluate if your strategy is interesting.

So obviously, some will say that it is not the same to trade with a virtual portfolio compared to real funds. And I completely agree. With real funds, emotions are multiplied. But virtual trading, if applied correctly and with good will, allows a first complete immersion in trading, and thus safely accelerates one’s learning of crypto trading.

If you want to learn crypto and bitcoin trading, botcrypto is for you! You can create virtual portfolios easily before getting down to business. Everything is explained in the video below.

Why is virtual crypto trading ideal to get started in crypto trading? Read More »