The Choppiness Index (also called Chop index) is a reliable indicator for detecting trends & consolidation phases. It is easy to use which makes it a good technical indicator when you are a beginner in technical analysis. The Choppiness Index was created by Australian commodity trader E.W. Dreiss, based on the chaos theory (i.e. the price action is not related to any model and cannot be predicted). This is a useful indicator that helps you to allocate your funds at the right time.

What is the Chop Index ?

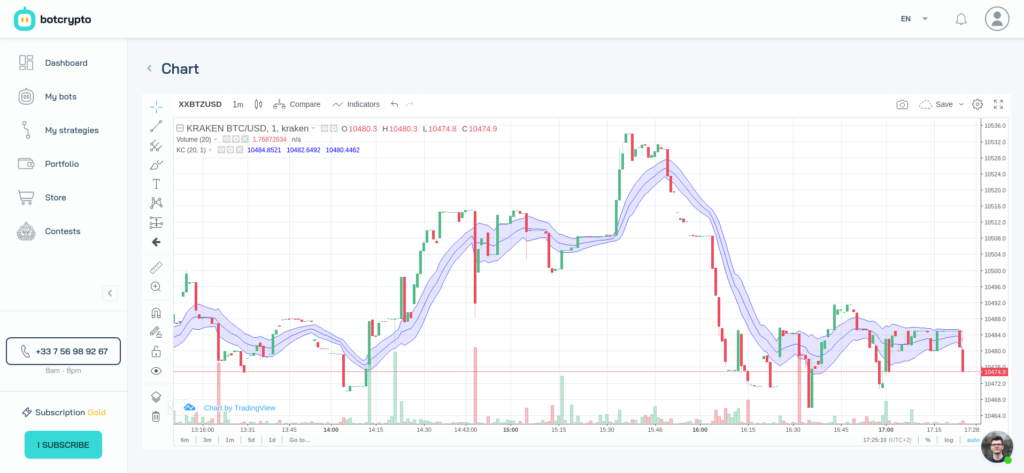

The Chop consists of one line that evoles in a defined range. When the Chop value is above the range, it means that the price finished its consolidation and the price will start a new trends, regardless of its direction (meaning that it can be an uptrend or a downtrend). When the Chop value is below the range, it means that the price finished its trend and will start its consolidation.

- If the chop index value is above 62, the price is ready to start a trend.

- If the chop index value is below 38, the price is ready to consolidate.

And the more extreme the value is, the sooner the price will enter into the phase. Think of it like an energy level of the price movement.

How is the Chop Index calculated?

Sum True Range for the past n periods.

Divide by the result of the following two steps:

Calculate the lowest TrueLow for n periods.

Subtract from the highest TrueHigh for n periods.

Calculate Log10 of the result then Multiply by 100.

Divide the result by Log10 of n.

NB : Usually, n is equal to 14 periods.

Mathematical Notation

Choppiness Index = 100 * Log10 { Sum(TrueRange,n) / [ Maximum(TrueHigh,n) – Minimum(TrueLow,n) ] } / Log10(n)

How to use the Chop Index ?

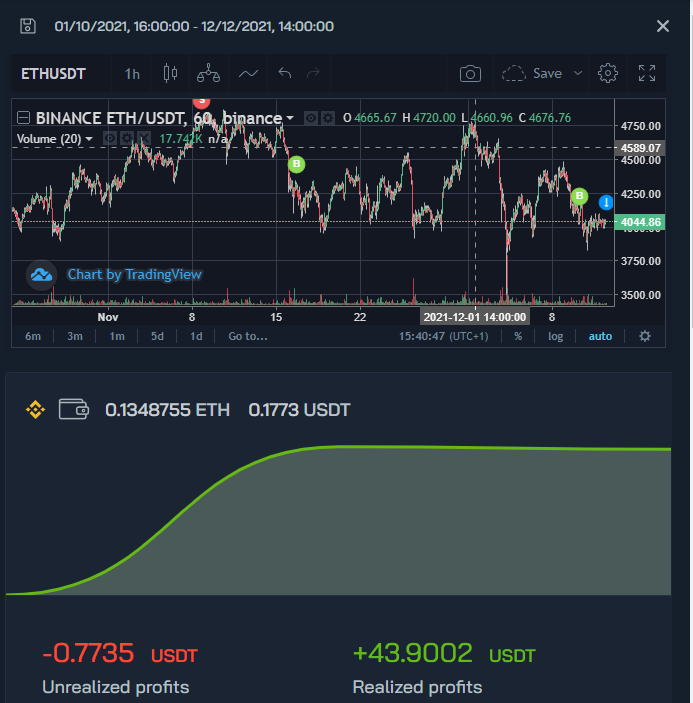

The main purpose of the Chop Index is to detect movements. So, the main use is to open an order when the trend is about to start and to close the order when the trend is about to consolidate.

- When the Chop Index is above 62,. This is a open order signal.

- When the Chop Index is below 38. This is a close order signal.

The strategy of incorporating the Chop Index can be used in 1H for intraday but can be more reliable on higher periods : 1D and 1W. It doesn’t tell you in which direction the price will go, but the momentum. Do not forget to mix it with trend indicators : RSI, Vortex, …

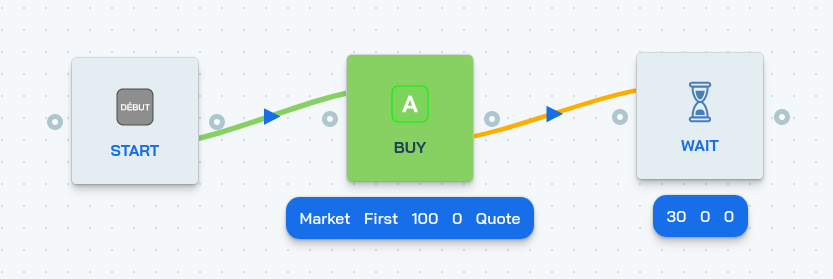

A trading bot with the Chop Index

The best part is that this demo strategy is available on the store on botcrypto. This means that you can now create a trading robot with this strategy!