With Dollar-Cost Averaging, invest serenely in bitcoin and cryptos

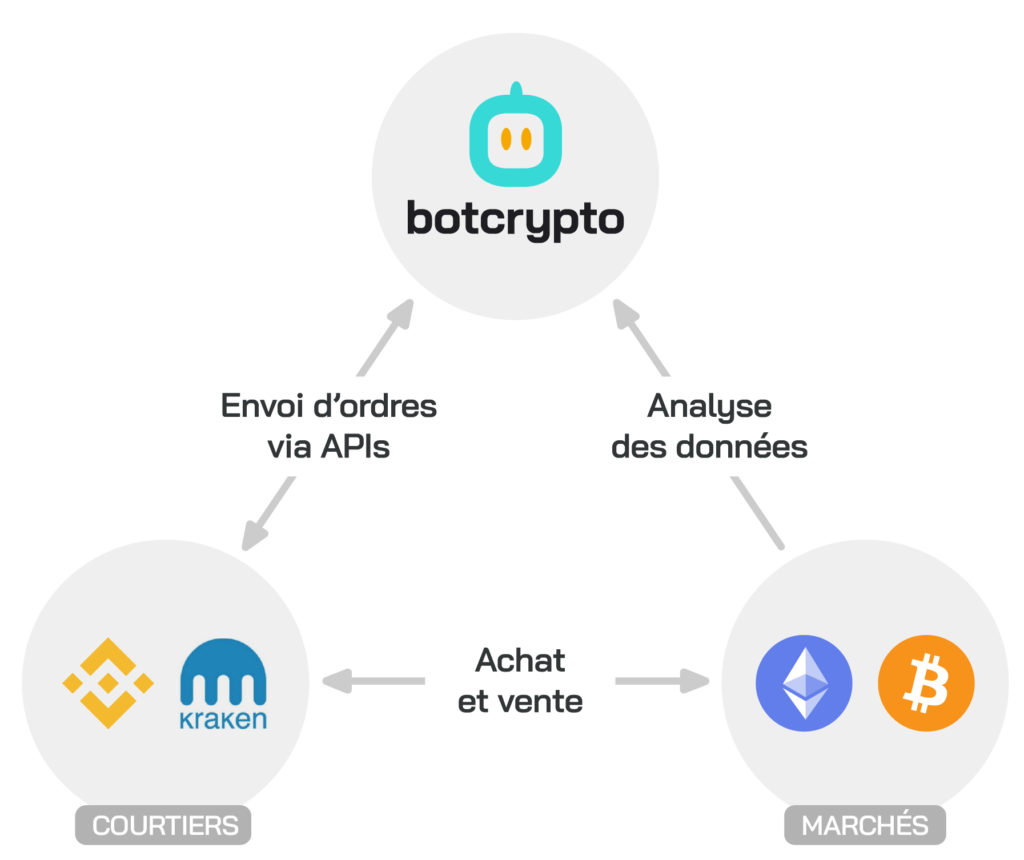

Have you heard of bitcoin? Do you want to invest in bitcoin or another cryptocurrency? Then Dollar-Cost Averaging is surely THE method you need to discover now.

What is Dollar-Cost Averaging?

This simple strategy consists of investing the same amount of money at regular intervals in order to reduce the risks associated with volatility. It is mainly intended for investors who aim for the long term. Instead of buying $1,000 of bitcoin tomorrow and taking the risk that it will lose 20% of its value in the following weeks, you can buy for $100 every month, thus smoothing your investment over time.

But does it actually work? Does Dollar-Cost Averaging improve returns and reduce risk in the long term?

Dollar-Cost Averaging in a concrete example

Let’s take a concrete example, where you discover bitcoin 3 years ago and see what happens with and without it.

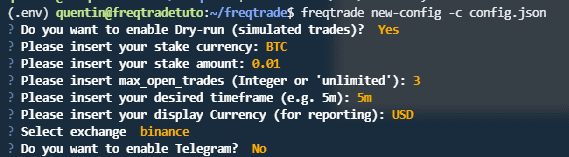

Without Dollar-Cost Averaging

If you had invested this 3600$ on December 3rd 2017, you would have received 0.32 BTC. 0.32 BTC is worth $6176 at the time of writing. It is therefore a good investment but the value of your investments will have fluctuated enormously over time especially with the bursting of the bubble in early 2018.

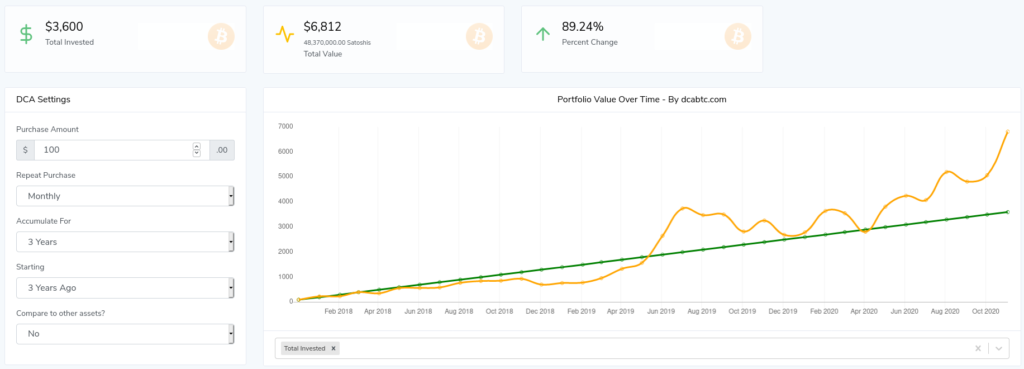

Without Dollar-Cost Averaging

Let’s imagine that instead of buying for $3,600 3 years ago, you would have bought $100 worth of Bitcoin every month. On the dcabtc.com calculator, we can see that with the Dollar-Cost Average strategy, you would have 6812$ today. That’s nearly $700 more by investing the same amount!

So obviously, this added value depends on when you start your investment. In some cases where you invest at exactly the right time, Dollar-Cost Averaging will be less effective. But investing at the right time is not that easy. Dollar-Cost Averaging overcomes this difficulty by smoothing investments and reducing the risk of investing at the wrong time.

How to make a success of this strategy?

You must be wondering why I’m talking about the success of his strategy. How could we fail? It’s quite simple, isn’t it? Well, it’s not.

First, you need to define the parameters of your Dollar-Cost Averaging strategy. For example, if you want to invest in Bitcoin, you can for example choose to invest €100 every month, or €20 per week, or even €5 per day! Of course, it all depends on how much you can afford and what you want. These parameters are at your discretion.

Then, the only rule is to respect these parameters. And you’ll see that it’s not going to be that easy, especially with cryptocurrencies, which are very volatile assets. When prices go up or down all at once, it’s going to be very tempting to accelerate your investments, or to let some time go by. But then you lose all the advantage of Dollar-Cost Averaging.

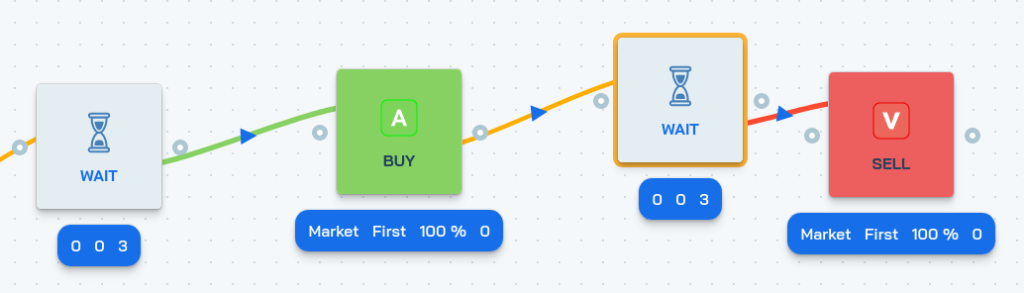

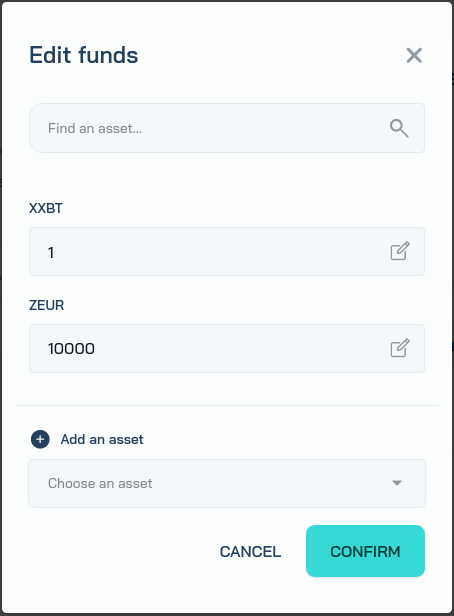

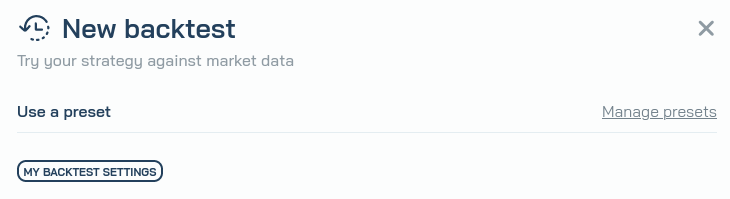

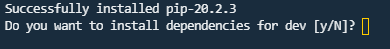

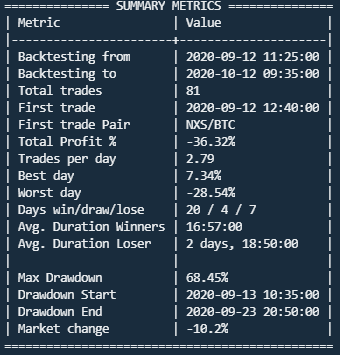

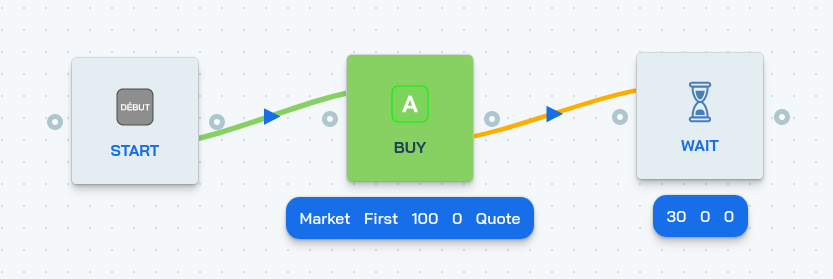

An interesting solution is to use software that sends the purchase orders for you. Our platform Botcrypto allows you to easily set up trading bots that apply Dollar-Cost Averaging strategies. With a few clicks you can start your trading bot that applies a strategy like the one below, where every month a buy order for $100 of Bitcoins is sent.

This way, no need to log on to an exchange every month. Your trading bots take care of applying your strategy for you. You can import this strategy for free from the Botcrypto store. It’s the Monthly DCA strategy.

In conclusion, Dollar-Cost Averaging is a very interesting investment method for all those who want to invest in Bitcoin and cryptocurrencies on a long-term basis, without having to think about it on a daily basis. With this method, you reduce the risk, both upwards and downwards, but what is certain is that you gain peace of mind!

With Dollar-Cost Averaging, invest serenely in bitcoin and cryptos Read More »